A Potential Resurgence in Digital Assets

Recent market activity suggests that Non-Fungible Tokens (NFTs) may be on the verge of a significant comeback. This speculation was ignited over the past weekend when a single, anonymous wallet executed a large-scale acquisition of 45 CryptoPunks, with the total transaction value exceeding $10 million.

For those unfamiliar, CryptoPunks are widely regarded as a "blue-chip" asset within the NFT space, having set numerous sales records of over $10 million for individual pieces throughout 2021 and 2022. Due to this prestigious status, the collection often serves as a bellwether for the entire NFT market. If the substantial investment this weekend is a reliable signal, the market could be poised for an upward trajectory.

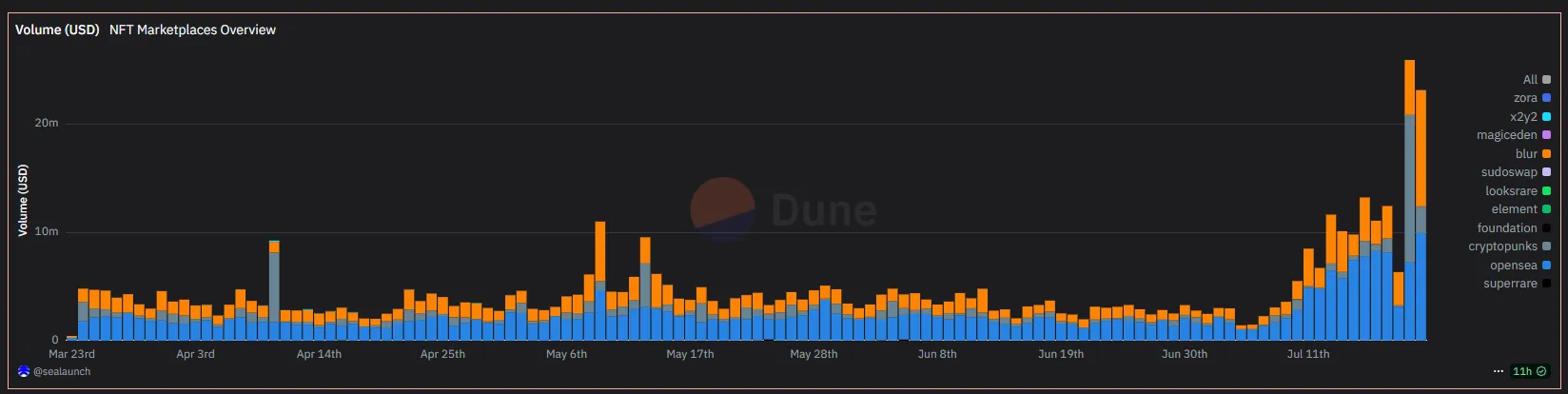

Daily NFT Marketplace Volume, Source: Sealaunch via Dune

Daily NFT Marketplace Volume, Source: Sealaunch via Dune

This event is particularly noteworthy as it marks the first time in recent memory that a heavily capitalized, anonymous wallet has "swept" a major collection since the market's previous peak. This revival in activity isn't isolated. Data reveals that OpenSea has been the primary beneficiary of a broader resurgence in NFT trading volume (excluding CryptoPunks, which operate on their own marketplace). This has fueled speculation about whether OpenSea is finally preparing for its long-awaited token launch. From a market timing perspective, current conditions are the most favorable for a Token Generation Event (TGE) in years. If an NFT bull run is indeed beginning, OpenSea could leverage the momentum to sustain a high valuation.

Shifting to the fungible token market, Bitcoin's price has entered a consolidation phase, holding steady around the $117,000 to $120,000 range. This stability has created an opportunity for select altcoins to reprice and recover. While the majority of altcoins may hold little intrinsic value, the recent market weakness caused many tokens representing fundamentally strong businesses to trade below their fair value.

Most of these promising projects fall within the Decentralized Finance (DeFi) sector. Protocols such as Aave, Curve, and Sky (formerly MakerDAO) have all posted significant gains over the last two weeks. According to data from DefiLlama, approximately 60% of all Total Value Locked (TVL) in crypto—a key metric for capital held within applications—resides on the Ethereum mainnet. This figure rises to nearly 70% when including its Layer-2 networks. Consequently, Ethereum's performance is intrinsically linked to the health of the DeFi sector, and the recent positive movement suggests this recovery may only be in its initial stages.